With this exercise, you can learn more about classification. You can try of different variants of linear regression on a data set and compare the performance with different metrics. You should also try to gain insights into the models through the coefficients.

Libraries and Data

Your task in this exercise is to try out different regression models, evaluate their goodness of fit and evaluate the meaning of the coefficients. You can find everthing you need in sklearn, statsmodel is another popular library for this kind of analysis.

We use data about house prices in california in this exercise.

We start by loading the required libraries and data.

import matplotlib.pyplot as plt

from sklearn import datasets, linear_model

from sklearn.metrics import mean_squared_error, r2_score

from sklearn.datasets import fetch_california_housing

from sklearn.model_selection import train_test_split

data = fetch_california_housing()

print(data.DESCR)

X = data.data

Y = data.target

predictors = data.feature_names

X_train, X_test, Y_train, Y_test = train_test_split(X, Y, test_size=0.5, random_state=42)

Train, Test, Evaluate

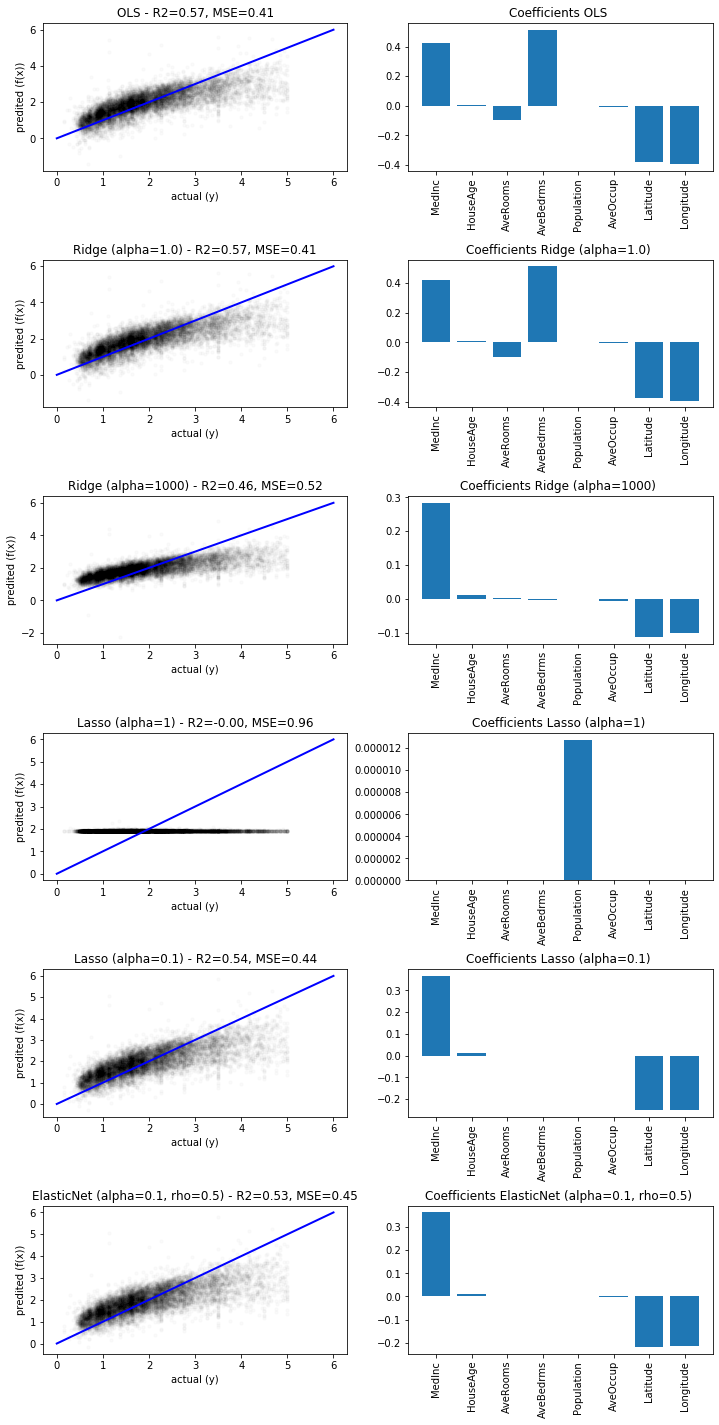

Now that training and test data are available, you can try out the different variants of linear regression. What happens when you use OLS/Ridge/Lasso/Elastic Net? How does the goodness of fit measured with $R^2$ on the test data change? Additionally, perform a visual evaluation of the results. How do the coefficients change?

We train and predict all models with scikit-learn. We try to values for of $\alpha$ for Ridge (1, 1000) and Lasso (1, 0.1). For the Elastic Net, we use $\alpha=0.1$ and $\rho=0.5$. We visualize the predicted versus the actual values and the coefficients of all models. The $R^2$ score and the MSE are printed in the heading of the plots.

# Setup models

models = [linear_model.LinearRegression(),

linear_model.Ridge(alpha=1),

linear_model.Ridge(alpha=1000),

linear_model.Lasso(alpha=1),

linear_model.Lasso(alpha=0.05),

linear_model.ElasticNet(alpha=0.1), ]

names = ['OLS','Ridge (alpha=1.0)', 'Ridge (alpha=1000)', 'Lasso (alpha=1)','Lasso (alpha=0.1)', 'ElasticNet (alpha=0.1, rho=0.5)']

# Training and prediction

Y_pred = {}

for i,model in enumerate(models):

model.fit(X_train,Y_train)

Y_pred[names[i]] = model.predict(X_test)

# Visualize Results

fig, axes = plt.subplots(len(models),2, figsize=(12,3.5*len(models)))

y_max = 6

for i, (model, name) in enumerate(zip(models, names)):

r2 = r2_score(Y_test, Y_pred[name])

mse = mean_squared_error(Y_test, Y_pred[name])

axes[i,0].set_title('%s - R2=%.2f, MSE=%.2f' % (name, r2, mse))

axes[i,0].scatter(Y_test, Y_pred[names[i]], color='black', s=10, alpha=0.02)

axes[i,0].plot([0, y_max],[0,y_max] , color='blue', linewidth=2)

axes[i,0].set_xlabel('actual (y)')

axes[i,0].set_ylabel('predited (f(x))')

axes[i,1].set_title('Coefficients %s ' % name)

axes[i,1].bar(predictors, model.coef_)

axes[i,1].tick_params(axis='x', labelrotation=90)

plt.subplots_adjust(left=None, bottom=0, right=None,

top=None, wspace=None, hspace=0.6)

plt.show()

We observe that all predictions, except those for Lasso with $\alpha=1$ are relatively similar in terms of $R^2$, MSE, and also with respect to the visual analysis. We also see that there is a all values of $y$ above 5 seem to be binned into the value 5.00001.

sum(data.target==5.00001)

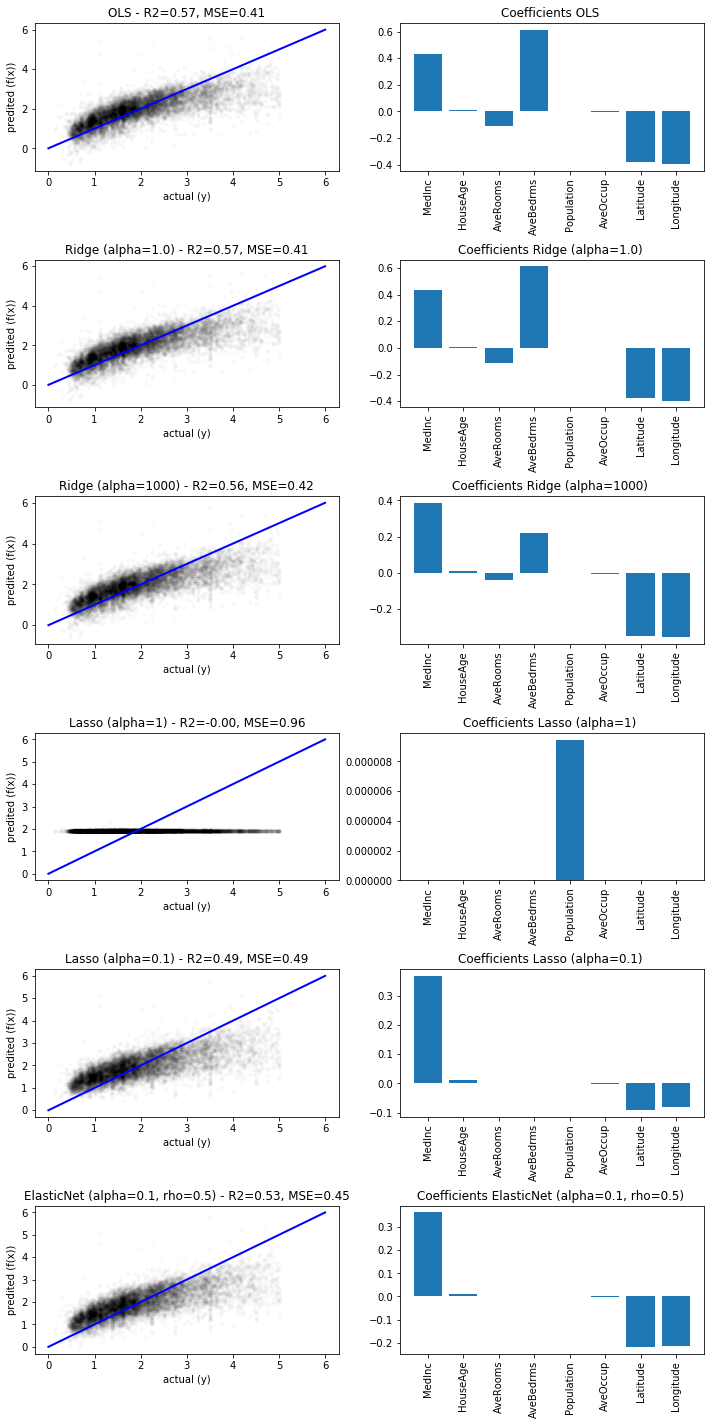

This happened, because we used the data, without a prior analysis of the distributions, as we explained in Chapter 3. We repeat the experiment, but drop all instance with $y>5$. This means we also need to repeat the train-test split.

print('Dropping %i instances before running regression' % sum(data.target>5))

X = data.data[data.target<=5]

Y = data.target[data.target<=5]

X_train, X_test, Y_train, Y_test = train_test_split(X, Y, test_size=0.5, random_state=42)

# Setup models

models = [linear_model.LinearRegression(),

linear_model.Ridge(alpha=1),

linear_model.Ridge(alpha=1000),

linear_model.Lasso(alpha=1),

linear_model.Lasso(alpha=0.1),

linear_model.ElasticNet(alpha=0.1), ]

names = ['OLS','Ridge (alpha=1.0)', 'Ridge (alpha=1000)', 'Lasso (alpha=1)','Lasso (alpha=0.1)', 'ElasticNet (alpha=0.1, rho=0.5)']

# Training and prediction

Y_pred = {}

for i,model in enumerate(models):

model.fit(X,Y)

Y_pred[names[i]] = model.predict(X_test)

# Visualize Results

fig, axes = plt.subplots(len(models),2, figsize=(12,3.5*len(models)))

y_max = 6

for i, (model, name) in enumerate(zip(models, names)):

r2 = r2_score(Y_test, Y_pred[name])

mse = mean_squared_error(Y_test, Y_pred[name])

axes[i,0].set_title('%s - R2=%.2f, MSE=%.2f' % (name, r2, mse))

axes[i,0].scatter(Y_test, Y_pred[names[i]], color='black', s=10, alpha=0.02)

axes[i,0].plot([0, y_max],[0,y_max] , color='blue', linewidth=2)

axes[i,0].set_xlabel('actual (y)')

axes[i,0].set_ylabel('predited (f(x))')

axes[i,1].set_title('Coefficients %s ' % name)

axes[i,1].bar(predictors, model.coef_)

axes[i,1].tick_params(axis='x', labelrotation=90)

plt.subplots_adjust(left=None, bottom=0, right=None,

top=None, wspace=None, hspace=0.6)

plt.show()

Interestingly, the results did not change much, except for Lasso with $\alpha=1.0$, which got even worse and now seems to yield an almost constant prediction. This is because the regularization strength is to high, meaning that it is better for the optimization to do nothing, than to actually fit a linear model. With $\alpha=0.1$ Lasso works as expected and drops some coefficients without a big loss in the goodness of fit. With Ridge, we observe the opposite with respect to $\alpha$. With $\alpha=1.0$, nothing happens. Only when we increase $\alpha$ to 1000, we see that the coefficients shrink: we observe that AveRooms and AveBedrms both shrink, where AveRooms is negative and AveBedRms is positive. Since it makes sense, that the number of rooms and the number of bedrooms is correlated, this makes sense. With Lasso, only the MedInc, house age, and Latitude, and Longitude survive. This indicates that in California the realter phrase "location, location, location" seems to be true.

Finally, we observe from the visual analysis, the the house prices seem to be roughly linear, but not completely. We see a systematic under prediction of house prices for the most expensive homes.